By Henri-Lee Stalk and Hilla Talati

As family businesses transition from their founding generation to subsequent generations, owners often find themselves navigating conflicting advice. Some advisors present the Family Constitution as a silver bullet that will resolve all governance challenges. Others position the Shareholder Agreement as the foundation upon which all other family enterprise structures must be built.

Both Family Constitutions and Shareholder Agreements are essential for maintaining effective governance in multi-generational family enterprises. The critical question is not which document you need—it’s determining which you need first and understanding the proper sequence for creating them.

This guide will help family business leaders understand why both documents are necessary, what each encompasses, and when the timing may be right to develop each one. Most importantly, we’ll explore why the collaborative process of creating these documents is just as valuable as their final content—and how this process can strengthen family unity and enterprise governance for generations to come.

Olivia’s Story: New Owners Needing a Legal Structure

As Olivia looked back on her family’s journey over the past five years, she felt proud of how far she and her second-generation siblings had progressed. Two years earlier, their father had transferred ownership of the business to the five of them—siblings who had already spent fifteen years working side by side. Recently, they had poured significant effort into clarifying their roles, defining how they would collaborate, agreeing on decision-making processes at both the ownership and management levels, and shaping their leadership model.

Their father was now handing over the last of his responsibilities to the sibling team. And while he had complete confidence in the next generation, Olivia still felt a quiet unease. Much had been accomplished—relationships strengthened, old conflicts addressed—but she feared that without clearly defined rules of the road for the future, tensions could resurface once their parents were no longer there to help mediate.

They still faced thorny issues: deciding on fair compensation, setting inheritance rules for the third generation, aligning on dividend policies, and determining protocols for acquiring or selling major assets. They also needed clarity around acceptable levels of debt and risk. The family had yet to agree on how to handle a sibling’s desire to exit ownership or step back from active management.

Above all, how could they make these decisions while preserving the close relationship they had developed as siblings?

Francisco’s Story: Preparing the Next Generation to be Stewards

As Francisco approached his 55th birthday, he reflected on the family business he had built over the past 20 years. Having witnessed the challenges that destroyed his own family’s business in the previous generation, he was determined to do things differently.

Francisco had clear principles: family members should prove themselves in the outside world before joining the business, and no one should view working in the family enterprise as an entitlement. But he faced a dilemma. To prevent any sense of entitlement among his three children, he rarely discussed the business with them. Yet he wanted them to eventually understand and inherit not just the company, but the values and principles that should guide it.

His children were now in their twenties, building their own careers. Soon he would need to begin conversations about the family’s future—but how could he articulate his expectations and values when he had spent years keeping them at arm’s length from the business? How could he ensure they understood what it meant to be part of this family enterprise before they ever became owners?

Francisco realized he needed a framework for these crucial conversations—something that would capture his philosophy about family, business, and the intersection between them. He needed a way to engage his children in discussions about what mattered most to the family, establishing clear expectations and values before ownership transfer ever became a consideration.

Both Olivia and Francisco are focused on building systems that establish clear expectations, boundaries, and guidelines for the future. Their aim is to promote family harmony and minimize potential conflicts. However, they need different tools at their respective stages of the family business journey.

What is the Core Purpose of Each Document?

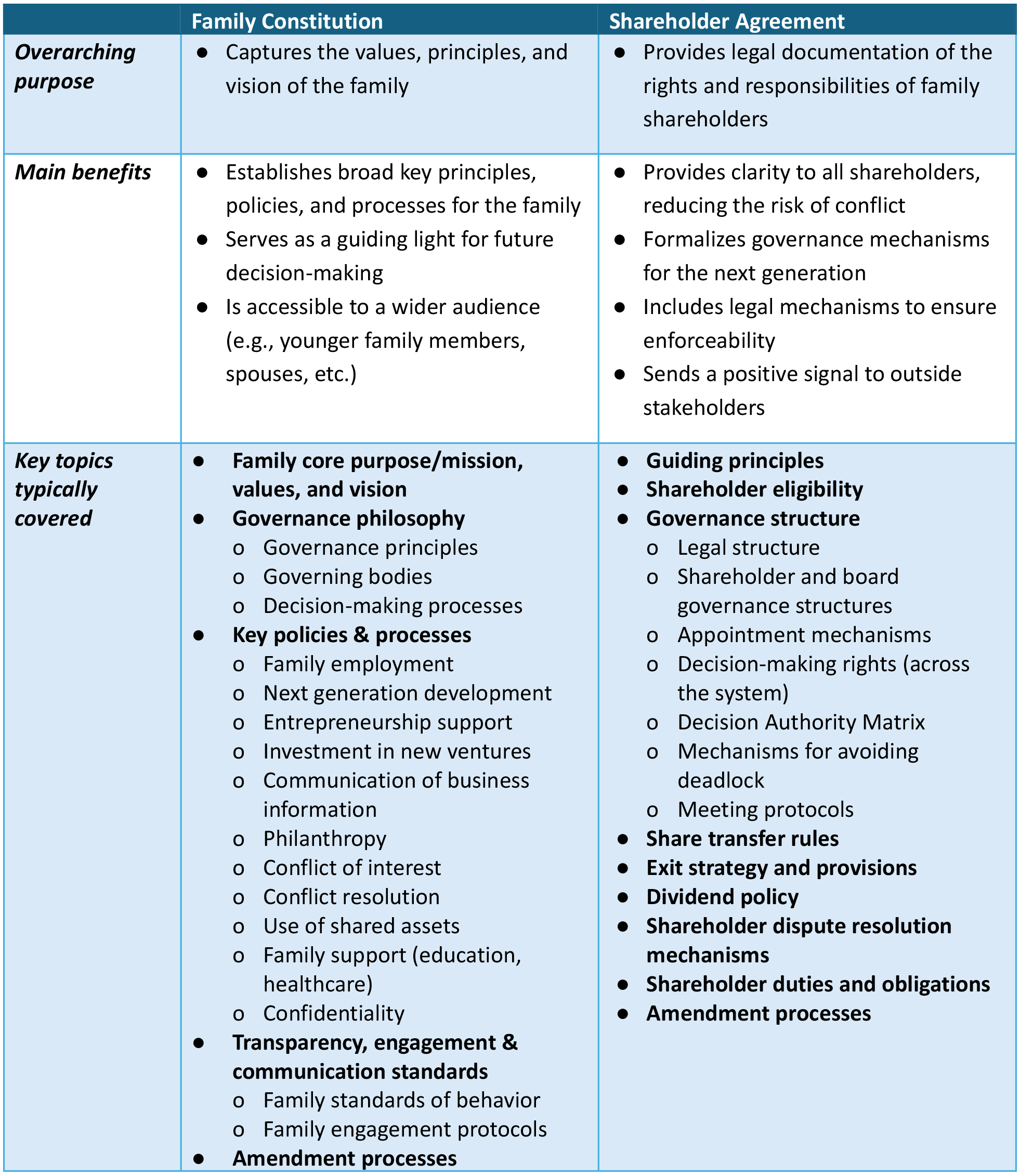

Both Family Constitutions and Shareholder Agreements play foundational, but distinct, roles in a family governance system.

The Family Constitution captures the business family’s core purpose, shared values, principles, and vision. It serves as a guiding framework for family members, outlining key expectations, policies, and processes that support decision-making and promote harmony.

Written for a broader audience beyond current shareholders, it provides guidance to family members from a young age about the family’s purpose, values, and vision for the future. The Family Constitution can also be shared with spouses to help them understand the family’s ethos—a valuable step, since spouses play a central role in developing the next generation.

In most cases and jurisdictions, a Family Constitution is not legally enforceable. While it serves primarily as a guiding framework, it can be referenced in legally binding agreements to make certain provisions legally binding.

Shareholder Agreement

The Shareholder Agreement is a legal document that governs the relationship between family shareholders regarding their jointly owned assets. It defines the rights and responsibilities of each shareholder and clarifies the governance structures and processes for the family enterprise, including how shareholder representation and decision-making will function.

A well-crafted Shareholder Agreement provides legal clarity while aligning with the principles and values set forth in the Family Constitution. It can also reassure non-family stakeholders, such as lenders and investors, of the family business’s strong governance, management, and stability, which may lead to lower capital costs and higher valuations.

What Should Be the Starting Point?

What Should Be the Starting Point?

Olivia and her siblings realized they needed a Shareholder Agreement first. Their ownership stakes were clear, but they required a formal contract to manage practical details—share transfers, voting procedures, and dividend handling. They lacked clarity around resolving ownership disputes, making key decisions, and handling situations where someone might exit the business or need to transfer or sell shares.

Start with a Shareholder Agreement if:

Ownership has already been transferred to the next generation of family members, but:

- Multiple owners now require legal documentation of rights, responsibilities, and dispute resolution

- Tax advantages are beneficial for estate planning

- Contingency planning is needed for shareholder death or incapacity

- Ownership qualifications and eligibility criteria require clarification

- Decision-making processes need definition

- Exit and liquidity strategies require attention

- Share valuation methods must be established

- Voting procedures need formalization

- Dividend policies must be defined

Business-owning families often require shareholder agreements in situations including family transitions like death and succession, which agreements address through clear succession plans. They also help with internal conflicts from family disputes and performance issues, which agreements manage through structured decision-making processes and conflict resolution mechanisms. Financial disputes over dividends and compensation are situations which agreements prevent by establishing predetermined distribution policies. External threats like divorce and creditor claims are circumstances which agreements block through protective clauses that maintain family control. Governance failures and deadlocks are problems which agreements resolve by defining clear voting procedures and decision-making authority.

When to Start with a Family Constitution

For Francisco, a Family Constitution was precisely what his family needed. His first step was engaging the next generation in conversations about what mattered most to the family. The process of co-creating the Family Constitution offered a meaningful opportunity for this dialogue before ownership transfer occurred.

Start with a Family Constitution if:

- The ownership purpose, mission, vision, and values for holding business assets together requires articulation

- Communication and information sharing processes about the family enterprise between members working in and outside of the business need to be defined

- Policies on financial support (weddings, education, etc.) and use of shared property and assets across relatives are needed

- Employment guidelines, next-generation development, and career paths require establishment

- How relatives should approach issues like new ventures, conflicts of interest, media interactions, etc. requires development

Family situations where a Family Constitution creates significant value include when multiple generations are joining the business, providing an opportunity to establish clear communication channels between active and passive family members while aligning everyone around a shared long-term vision. Growing family involvement presents the perfect time to develop comprehensive financial support policies, shared asset guidelines, and structured career development programs that help next-generation members thrive in their chosen paths. Families benefit greatly from a Constitution when they want to establish effective protocols for evaluating new ventures, managing conflicts of interest, and coordinating media interactions, etc. while strengthening their core values and reinforcing their shared purpose for remaining business partners.

How the Process Creates the True Value

The real value of these documents lies in the collaborative process of creating them. Through conversation, reflection, and negotiation, families build clarity, alignment, and trust. A document is only meaningful when it reflects the genuine understanding and agreement of those it impacts.

As Olivia and her siblings negotiated their Shareholder Agreement, they addressed important questions like inheritance policies. When one sibling mentioned considering adoption, everyone agreed that adopted children should be treated equally with biological children regarding ownership inheritance. This conversation strengthened family bonds while clarifying future policies.

For Francisco’s family, discussions about communication standards between shareholders—whether working inside or outside the business—proved especially valuable. These conversations gave one of his children reassurances that pursuing an external career wouldn’t compromise their ability to stay informed and included as a future shareholder.

Success comes from choosing the right tool at the right stage of your family’s journey. Family Constitutions and Shareholder Agreements serve distinct purposes and deliver maximum value when applied at the appropriate moment.

Taking Action

For families like Francisco’s, where the next generation is still developing and ownership transfer lies in the future, the Family Constitution lays the foundation—establishing values and expectations before formal ownership structures take shape.

For families like Olivia’s, where ownership has already transferred and decision-making clarity is urgent, the Shareholder Agreement takes priority—defining legal structure and protecting both relationships and business interests.

The key is recognizing your family’s current stage and acting accordingly, knowing that both documents will eventually become essential pillars of your governance framework. Families that thrive across generations create the right tool at the right moment, rather than waiting for a crisis to trigger difficult conversations.

Whether you begin with a values-first approach like Francisco’s or a practical, ownership-focused approach like Olivia’s, the transformation comes from the process itself. Through open conversations and mutual understanding, families build the trust and clarity needed to make wise decisions and thrive for generations.