Originally published in Harvard Business Review – Click here for the original article

An emerging set of best practices can turn the age-old problem of generational succession into an opportunity to thrive.

By George Stalk and Henry Foley – January 2012

Nearly 75 years ago a charismatic Brazilian entrepreneur named Enrique Rosset started an eponymous textile and apparel manufacturing company in São Paulo. Some 40 years later he and his oldest son decided to diversify by acquiring Valisere, an upscale but failing lingerie business. Over the decades, Enrique and his four sons transformed their operation into one of South America’s leading textile and apparel manufacturers. During the 1990s Grupo Rosset expanded into swimwear, with great success. But the family knew the business faced critical strategic challenges. The rise of shopping malls was weakening the small Brazilian retailers who’d made up Rosset’s primary distribution channel. Chinese imports were beginning to pose serious competition. The advent of digital fabric printing would undercut Rosset’s core manufacturing strength unless the company adopted the technology itself. Enrique’s sons, who’d led the firm for 20 years, had to make a crucial decision about which of the five members of the third generation should assume the leadership role.

Nearly 75 years ago a charismatic Brazilian entrepreneur named Enrique Rosset started an eponymous textile and apparel manufacturing company in São Paulo. Some 40 years later he and his oldest son decided to diversify by acquiring Valisere, an upscale but failing lingerie business. Over the decades, Enrique and his four sons transformed their operation into one of South America’s leading textile and apparel manufacturers. During the 1990s Grupo Rosset expanded into swimwear, with great success. But the family knew the business faced critical strategic challenges. The rise of shopping malls was weakening the small Brazilian retailers who’d made up Rosset’s primary distribution channel. Chinese imports were beginning to pose serious competition. The advent of digital fabric printing would undercut Rosset’s core manufacturing strength unless the company adopted the technology itself. Enrique’s sons, who’d led the firm for 20 years, had to make a crucial decision about which of the five members of the third generation should assume the leadership role.

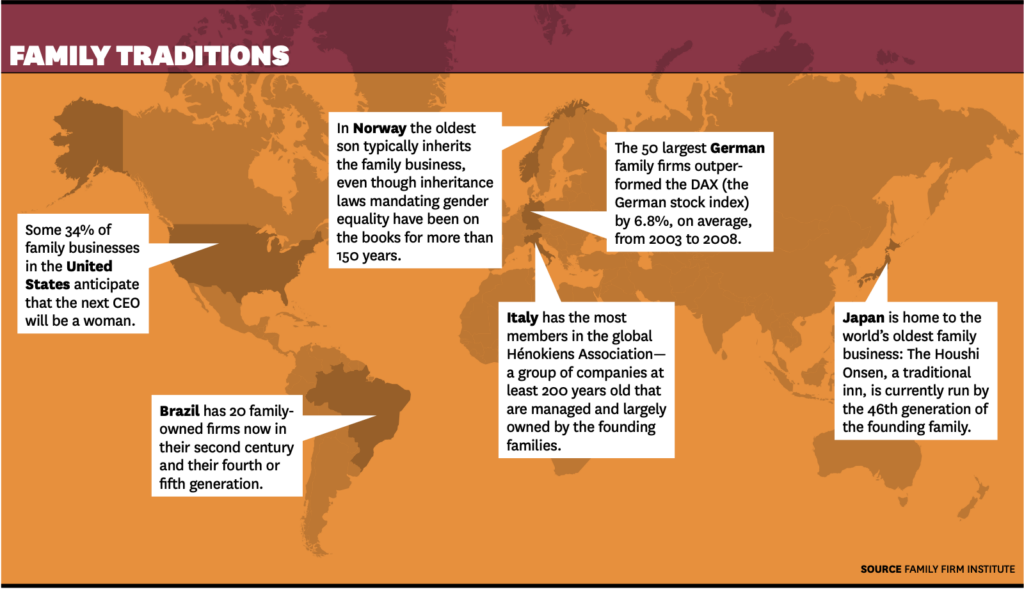

In the United States, a familiar aphorism—“Shirtsleeves to shirtsleeves in three generations”—describes the propensity of family-owned enterprises to fail by the time the founder’s grandchildren have taken charge. Variations on that phrase appear in other languages, too. The data support the saying. Some 70% of family-owned businesses fail or are sold before the second generation gets a chance to take over. Just 10% remain active, privately held companies for the third generation to lead. In contrast to publicly owned firms, in which the average CEO tenure is six years, many family businesses have the same leaders for 20 or 25 years, and these extended tenures can increase the difficulties of coping with shifts in technology, business models, and consumer behavior. Today family firms in developing markets face new threats from globalization. In many ways, leading a family-owned business has never been harder.

The high failure rates of family businesses may seem unavoidable. They’re not. In our work advising these types of companies, we see them repeatedly caught in the same traps. Recognizing and learning to avoid those traps can boost the odds of long-term survival.

TRAP #1

“There’s Always a place For You Here”

Some proprietors of family-owned firms make their children feel obligated to join the company, which can backfire by creating a crop of managers who aren’t interested in being there. More often, though, we see parents emphasize that their off-spring are free to join the business if they so choose. If the company is successful, those children are likely to have been raised amid wealth, which broadens their choices as adults. Generally this situation translates into an unspoken promise that “there’s al-ways a place for you here,” which can lead children to treat the business as a fallback option. We’ve encountered many companies that are populated by next-generation members who failed in other businesses or spent their 20s (and sometimes their 30s) as aspiring athletes, artists, or musicians before signing on to the firm as unprepared 40-somethings. Despite their lack of experience, these offspring may ascend to leadership positions because of the family connection, increasing the chances that the business will fail.

To escape the trap: Insist on proper training and screening. It’s natural for a family business to welcome members of the next generation, and it’s healthy to ex-pose them to the company at an early age, so that they can make an informed decision about whether to pursue a career there. But a job with the company shouldn’t be an entitlement. Those who want to join deserve no special accommodation. We now see an emerging best practice in which families formally require any child who wants a job to (a) earn a university degree—and in some cases a graduate degree, (b) gain several years of relevant professional experience outside the family business, and (c) apply for open positions in competition with nonfamily applicants. At one Euro-pean firm we know of, family members applying for a job must be at least 26 years old, have earned a master’s degree in business or engineering, speak three languages, and have won two promotions within five years at a nonfamily firm. And they are given only one opportunity to apply: If they’re turned down, they must go elsewhere.

To escape the trap: Insist on proper training and screening. It’s natural for a family business to welcome members of the next generation, and it’s healthy to ex-pose them to the company at an early age, so that they can make an informed decision about whether to pursue a career there. But a job with the company shouldn’t be an entitlement. Those who want to join deserve no special accommodation. We now see an emerging best practice in which families formally require any child who wants a job to (a) earn a university degree—and in some cases a graduate degree, (b) gain several years of relevant professional experience outside the family business, and (c) apply for open positions in competition with nonfamily applicants. At one Euro-pean firm we know of, family members applying for a job must be at least 26 years old, have earned a master’s degree in business or engineering, speak three languages, and have won two promotions within five years at a nonfamily firm. And they are given only one opportunity to apply: If they’re turned down, they must go elsewhere.

Even firms that already employ many family members can benefit from rigorous performance and potential assessments. At Gerdau S.A., the four brothers in the fourth generation of the Johannpeter family had run the business very profitably for more than 20 years when they began thinking about succession, in the mid-1990s—long before they planned to step aside. They hired a search firm to evaluate Gerdau’s top 60 executives, including five next- generation family members, for appointment to a newly created executive commit-tee. They used this objective assessment to encourage some family members to pursue careers outside the business. Those people left gracefully and did well in other endeavors.

A job with the company shouldn’t be an entitlement. Family members deserve no special accommodation.

Four years later the family worked with another set of outside advisers to identify five candidates for CEO. Among those recommended were two fifth-generation cousins with extensive experience in the business. The company sent the two for advanced executive training at leading U.S. business schools and subsequently put them in charge of key business units for several years. In late 2006 the top- performing family member was appointed CEO, and his cousin became COO. Today four of the five CEO candidates remain with Gerdau, and the company’s revenues have grown from $13 billion in 2006 to $20 billion in 2010.

Trap #2

Trap #2

The Business Can’t Grow Fast Enough to support Everyone

An underappreciated problem is that families often grow more quickly than their businesses do. If a company founder has three children, each of whom marries and produces three more children, each of whom marries, within three generations there could be 25 people or more (including all the spouses) working or looking to work at the company. Many businesses simply don’t have enough work to employ every family member.

To escape the trap: Manage family entry and scale for growth. Families that have avoided Trap #1 by ensuring that only committed, qualified relatives are allowed to join the firm have already reduced the magnitude of Trap #2. Another solution is to develop strategies to grow the business and create responsibilities for additional family employees.

Mitchells, a high-end clothing retailer in Westport, Connecticut, took this approach. Jack Mitchell and his brother, Bill, inherited the store from their father, Ed, who’d founded it in 1958. A decade ago, as Jack and Bill anticipated handing leadership to their seven children (each of whom had graduated from college and obtained relevant experience before joining the store), they realized that the business would have to grow to provide enough high-level roles to go around. Mitchells’ key strength is a customer relationship management system that helps salespeople bond with clients and suggest suitable products for them. In 1995 Mitchells bought a failing men’s clothier in nearby Greenwich and utilized its own CRM system to turn the store around. Since then it’s acquired retailers on Long Island and in northern California and has dispatched members of the next generation to run the stores in those locations. This strategy not only provided sufficient revenue to support the various family employees but also gave all of them their own operations to lead.

Trap #3

Family Members remain in silos According to Bloodline

One of the most striking things we’ve noticed about family businesses is the tendency of fathers and sons (and increasingly daughters) to specialize in the same aspect of the business, whether it’s finance, operations, or marketing. This can be problematic for several reasons. First, by stay-ing in specialized silos, next-generation managers fail to gain the cross-functional expertise needed for executive leadership. Second, when close family members supervise one another, the personal dynamic can prevent candid feedback and interfere with coaching. Together these factors can create a leadership vacuum in the up-and-coming generation. This may prompt the current generation to stay in the top positions too long, limiting the company’s adaptability to change.

To escape the trap: Appoint non-family mentors. In a small enterprise, it may be impractical to prohibit family members from supervising one another. But even in these cases, companies should minimize the time that employees spend working for immediate relatives. Some companies assign an experienced non-family mentor to each younger family member, to provide the objective performance evaluation and critical advice an employee in a nonfamily business typically gets. For this to work, the coach must operate under a protective umbrella, immune from retribution by the family.

It’s unrealistic to think you can create a nepotism-free family-owned business, and it’s important to recognize that family enterprises will always operate by different rules. For instance, even the largest family-controlled, publicly traded firms manage dividends differently from the way non-family companies do. It’s also worth recognizing that family ownership can provide a welcome counterbalance to the short-term incentives offered to most managers. To survive over the long haul, however, family firms need to adopt formal policies about whom to employ, whom to promote, and how to balance family and business interests. If more companies take these steps and survive the treacherous transitions from one generation to another, everyone will benefit.

George stalk is a senior adviser and BcG fellow at the Boston consulting Group. Henry Foley is a senior partner at Generation Transition Advisors.